The financial markets present a dynamic landscape filled with opportunities and challenges. Conventional wisdom might suggest that investors who navigate this terrain with expertise—identifying areas of mispricing or capitalizing on emerging opportunities—are poised to achieve superior portfolio performance. After all, adjusting asset allocations in response to shifting market conditions should, in theory, deliver better returns than sticking to a fixed strategy. This concept forms the foundation of tactical asset allocation, a strategy that aims to outmaneuver market trends. Should investors embrace tactical adjustments to their asset allocation?

Tactical asset allocation (TAA) stands in stark contrast to strategic asset allocation (SAA). While SAA adheres to a disciplined, long-term framework—maintaining fixed allocations based on an investor’s objectives and risk tolerance—TAA involves frequent, short-term reallocations in response to perceived market conditions. These reallocations might span asset classes such as stocks, bonds, or derivatives. TAA is often touted by investment managers eager to showcase their skill and ability to “time the market.” Indeed, numerous tactical allocation funds have been available for decades, boasting teams of credentialed analysts and extensive resources. Yet, the question remains: How do these tactical funds measure up against a straightforward, strategic approach?

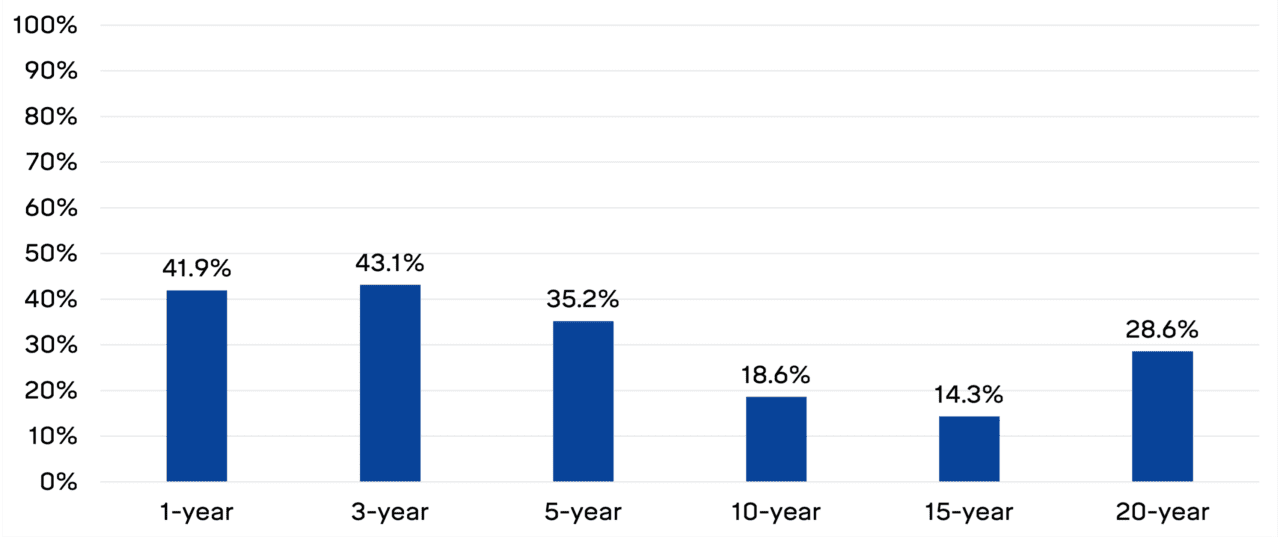

The chart below shows the outperformance rate of tactical asset allocation funds vs. a strategic 60/40 strategy.

Outperformance rate of tactical allocation funds vs. a strategic 60/40 allocation

Despite the allure of TAA, the evidence tells a different story. Over time, tactical allocation funds consistently underperform their strategic counterparts, with the gap widening over longer horizons. Tactical asset allocation’s frequent adjustments may be more aligned with the industry’s incentive to demonstrate active management rather than deliver consistent, long-term returns.

The allure of tactical strategies is understandable. Market volatility can provoke a sense of urgency, tempting investors to “do something” in response to every fluctuation. However, history has shown that staying the course with a strategic, globally diversified allocation often yields better outcomes. Avoiding the siren song of market timing isn’t just prudent—it’s a proven path to long-term success. For investors, this timeless advice underscores the value of patience, discipline, and trust in a strategy built for the long haul. While a well-known refrain is “Don’t just stand there, do something!”, when it comes to investing a better approach in the words of the late founder of Vanguard, Jack Bogle, is, “Don’t just do something, stand there!”