Lately, tariffs and trade wars have dominated market narratives. If you’re wondering, “Will tariffs tank the economy—and my investment portfolio along with it?” the short answer is: Maybe.

The uncertainty stems from the fact that global trade, the economy, and the stock market are deeply interconnected in ways that don’t lend themselves to simple analysis. However, despite the complexity, we can break tariffs down into three key perspectives:

1. Consumers: Higher Prices at Checkout

Tariffs function as taxes on imports, and those costs don’t just disappear—they get passed on. Importers typically raise prices to compensate, meaning consumers end up paying more for goods, from electronics to everyday essentials.

2. The Economy: A Drag on Growth

Experts widely agree that tariffs are a net negative for the economy. Their effects include:

- Higher inflation, as businesses pass costs along to consumers.

- Slower GDP growth, as trade restrictions hurt business efficiency.

- Lower employment, as companies adjust to higher costs.

- Reduced consumer spending, as households face rising prices.

(These effects are supported by various academic and governmental studies analyzing past tariff regimes, including the recent 2018-2019 trade war)

3. Markets: Volatility and Uncertainty

While the economy and stock market are linked, they don’t always move in lockstep. Markets, in particular, despise uncertainty—and tariff-related uncertainty is running high. Consider how trade headlines can shift within hours:

- Morning: “Tariffs on Canada and Mexico to begin!”

- Afternoon: “Trump to delay Canada, Mexico tariffs on autos for one month.”

- Next day: “Trump tariffs: Mexico given month-long reprieve.”

With tariffs often used as bargaining tools, it’s nearly impossible to assign a high probability to any one outcome. The result? Market volatility.

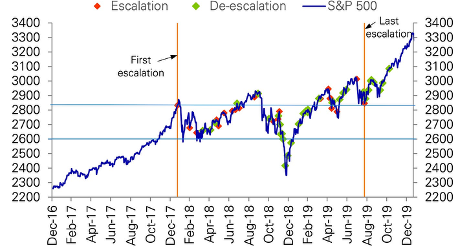

Take a look at the S&P 500 performance during Trade War 1.0 (2018–2019). It was a bumpy ride, with stock market reactions likely influencing some policy adjustments. Will history repeat itself? That’s anyone’s guess.

Trade War Events and S&P 500 in 2018-2019

Yet, over the long term, markets have shown resilience. Companies adapt, find workarounds, and adjust to new realities.

What Should Investors Do?

Navigating tariff uncertainty isn’t easy, but here are three principles to keep in mind:

1. Don’t Let Political Headlines Dictate Investment Decisions

Policy uncertainty is temporary. Eventually, unknown risks turn into known (and manageable) risks. Reacting emotionally to every market jolt often leads to poor decisions.

2. Take the Long View and Avoid Market Timing

Economic cycles come and go, and the stock market will always have ups and downs. It’s tempting to try predicting highs and lows, but even the experts can’t do it consistently. Instead, stick to a well-diversified, long-term strategy.

3. Focus On What You Can Control

Rather than obsessing over trade policy, ensure your portfolio is built for resilience. Diversification across asset classes, maintaining a strong cash position, and aligning your investments with long-term goals will help you weather uncertainty. While tariffs may rattle markets in the short term, history suggests that bu