Key Takeaways:

- Structure Drives Liquidity, Access, and Investor Experience — Evergreen funds are operationally easier to access but require diligence and uncertainty about valuation. They offer continuous capital deployment, simplified exposure, and more frequent liquidity than traditional drawdown funds. However, redemptions can be limited, and NAV-based pricing can be ambiguous.

- Returns are Shaped by Design, Not Just Performance Metrics — Drawdown funds tend to show higher IRRs, while Evergreen funds prioritize compounding returns through full investment from day one. Comparing these structures purely on IRR misses the bigger picture. Investors should evaluate how each structure aligns with their capital allocation goals, return timelines, and liquidity preferences.

- Cost and Complexity Aren’t Always Visible Upfront — Investors need to look past the headline fee as Evergreen funds often appear to have lower fees. However, they typically cost more due to how fees are calculated based on NAV including unrealized gains. Broad diversification in Evergreen funds may reduce volatility but can also dilute return potential compared to focused drawdown strategies.

“Neither IRR nor MOCC nor MOC – nor any other single metric – is sufficient to tell us whether [a] GP did a good job”

– Howard Marks, Lines in the Sand

Sophisticated investors understand that no single metric defines the success of a private investment. Just as Internal Rate of Return (“IRR”) alone can be misleading without context, evaluating an investment vehicle such as an evergreen fund requires a multidimensional view. Performance, liquidity, fee structure, operational complexity, and portfolio fit all play a role. Evergreen funds are emerging as a flexible alternative to the traditional drawdown model, promising continuous exposure to private assets, simplified capital deployment, and potentially enhanced compounding. But how do they truly compare, and what should investors consider when determining their place within a broader private markets strategy?

Evergreen vs. Drawdown Funds: The Structural Divide

Traditional private equity “closed-end” funds employ a drawdown model that calls for capital over a 3- to 5-year timeline. Investors commit capital upfront during a fundraising period, which is drawn over 3-5 years and invested in private companies by the General Partner (GP). Distributions back to the investors occur at the GP’s discretion when the private assets owned by the fund are sold or restructured. The drawdown model focuses on generating strong returns on invested capital. The drawback, however, is that this structure requires investors to manage unfunded commitments and reinvest distributions efficiently.

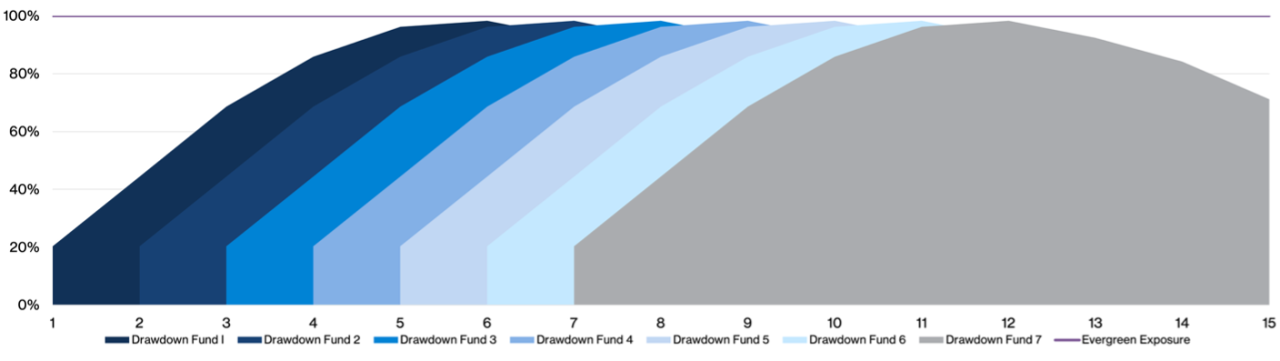

By contrast, evergreen, or “open-end,” funds offer continuous capital inflows and remain perpetually open, eschewing the drawdown model’s traditional fundraising, investing, and harvesting periods. Investments by the limited partners are made at the portfolio’s Net Asset Value (“NAV”), providing immediate exposure to diverse investments. Traditional drawdown funds experience a J-curve effect where cash is invested sporadically over the first few years, leading to low or even negative performance over the short term. Evergreen funds mitigate that phenomenon by fully investing commitments on day one into an already mature portfolio of assets. Returns generated by the companies owned by the fund are reinvested rather than distributed back to investors, which enables compounding inside the fund. Evergreen funds mitigate their illiquid nature by allowing quarterly redemptions, although these are limited and may be entirely restricted during periods of market stress.

Achieving the Target Private Allocation

Source: PitchBook.

While evergreen funds’ open-ended structure simplifies private market investing, it raises additional issues that investors should consider.

Performance Trade-Offs: IRR vs. Compounding Returns

Historically, drawdown funds have delivered superior IRRs than evergreen funds. According to PitchBook data, drawdown funds typically outperform evergreen structures by 2.25% to 2.75% annually in private equity and 1.5% to 1.75% in private credit. This advantage stems from drawdown funds’ ability to optimize exits, avoid allocating a portion of the portfolio to liquid assets to support redemptions, and structure fees more favorable to investors. Plus, drawdown funds are designed to maximize IRR by giving the GP more discretion over cash flow timing.

However, evergreen funds have a structural advantage. Because capital is deployed on day one, investors avoid the drag of holding uncalled commitments in lower-returning liquid investments. A fund that is 100% invested on day one should have a greater opportunity to compound wealth compared to a fund that takes three to four years to become 100% invested.

The difficulty lies in comparing performance between these two fund structures. Drawdown funds rely on IRR for fund performance measurement because IRR effectively measures irregular cash flows. On the other hand, Evergreen funds utilize simple annualized returns because there are no irregular cash flows to consider. Thus, it is not an apples-to-apples comparison to say that drawdown funds offer a higher IRR than evergreen funds.

For investors, the key question is not simply which structure delivers higher nominal returns but how each aligns with capital allocation strategies and liquidity preferences. When evaluating private fund performance, shifting to a more holistic approach, combining IRRs with investment multiples to understand the complete picture of returns is necessary.

Liquidity and Investor Considerations

One of the most compelling features of evergreen funds is their potential to democratize private market access, particularly for individual investors and family offices that may lack the infrastructure to manage drawdown capital calls and reinvestments that institutional investors have.

However, liquidity remains a double-edged sword. While evergreen funds provide more frequent redemption options than drawdown structures, they are still constrained. Many funds impose redemption limits, often 5% of the net asset value (“NAV”) per quarter, and reserve the right to suspend withdrawals, particularly during economic downturns.

Additionally, NAV-based pricing can be opaque, making interim valuations more subjective than those of a drawdown structure. Unlike drawdown funds, where underlying investment valuations are determined at the point of a transaction between two parties at an agreed-upon price, evergreen funds rely on periodic mark-to-market estimates, which vary depending on the methodologies used by fund managers. This leads to discrepancies between reported NAV and actual exit values.

As a result, investors face uncertainty about the accuracy of their holdings’ valuations, which can affect decisions on redemptions and allocations. According to PitchBook research, evergreen fund valuations can be more volatile during market dislocation, as managers must balance liquidity provisions with maintaining portfolio integrity.

As investors demand more liquidity from their private investments, they must be willing to accept the manager’s valuation methodology at any point instead of only at the time of a transaction. This creates another layer of diligence for investors evaluating these opportunities.

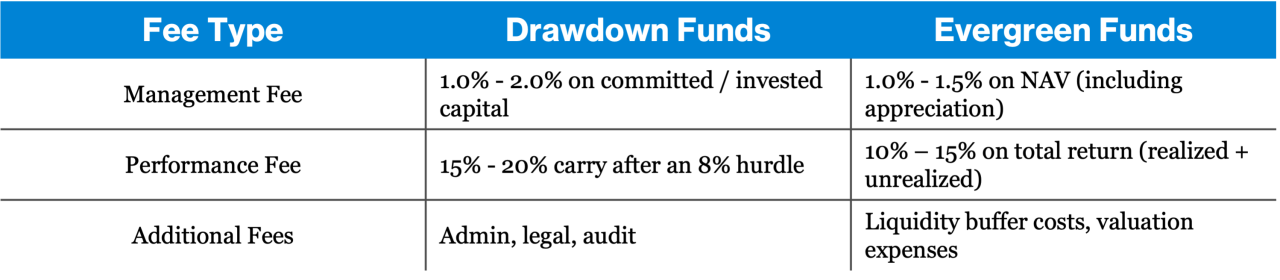

The Fee Equation: Transparency vs. Cost Efficiency

Evergreen funds often advertise lower management fees than drawdown funds. However, even though the headline fee percentages may be lower, when you examine how fees are charged under each structure, drawdown funds are usually cheaper.

Capital is 100% invested from the outset in an evergreen fund, and fees are charged on the net asset value (NAV), including both the invested capital and any appreciation (whether realized or unrealized). This means that evergreen fund investors pay for appreciation often before returns are realized. By contrast, drawdown funds charge management fees based on committed capital during the investment period, transitioning to fees on invested capital as the portfolio matures. While paying fees on uncalled capital is expensive, the transition to paying fees on invested capital that isn’t marked to NAV is a fee benefit compared to evergreen funds. As drawdown fund assets are sold and capital is harvested, the fee base contracts again.

These differences in fee structures are complex to analyze and depend on how the funds perform. The key point is that investors should not get sucked into thinking that evergreen funds are cheaper because the listed fees appear lower.

The opposite is true—evergreen funds usually are more expensive.

Composition of Evergreen Funds

Evergreen funds are designed to provide consistent exposure to private markets while balancing liquidity needs and capital efficiency. As a result, their asset composition is more diversified than traditional drawdown funds. Evergreen funds allocate capital across a mix of private equity, private credit, real estate, and infrastructure, focusing on income-generating assets to support liquidity needs. Private credit is a crucial component, as it provides steady cash flows to help fund redemptions without necessitating asset sales. Real estate and infrastructure investments offer additional stability, as they tend to have long-term cash yield characteristics. Some funds include secondaries and co-investments, providing immediate deployment and vintage diversification. By maintaining a diversified mix, evergreen funds aim to mitigate volatility while preserving access to the return potential of private markets.

While diversification is often beneficial, broad private market diversification across multiple asset classes leads to middling returns similar to public market strategies. Investors looking for illiquidity premiums in private markets would be better off focusing on asset classes where return persistence exists instead of spreading bets across all sectors.

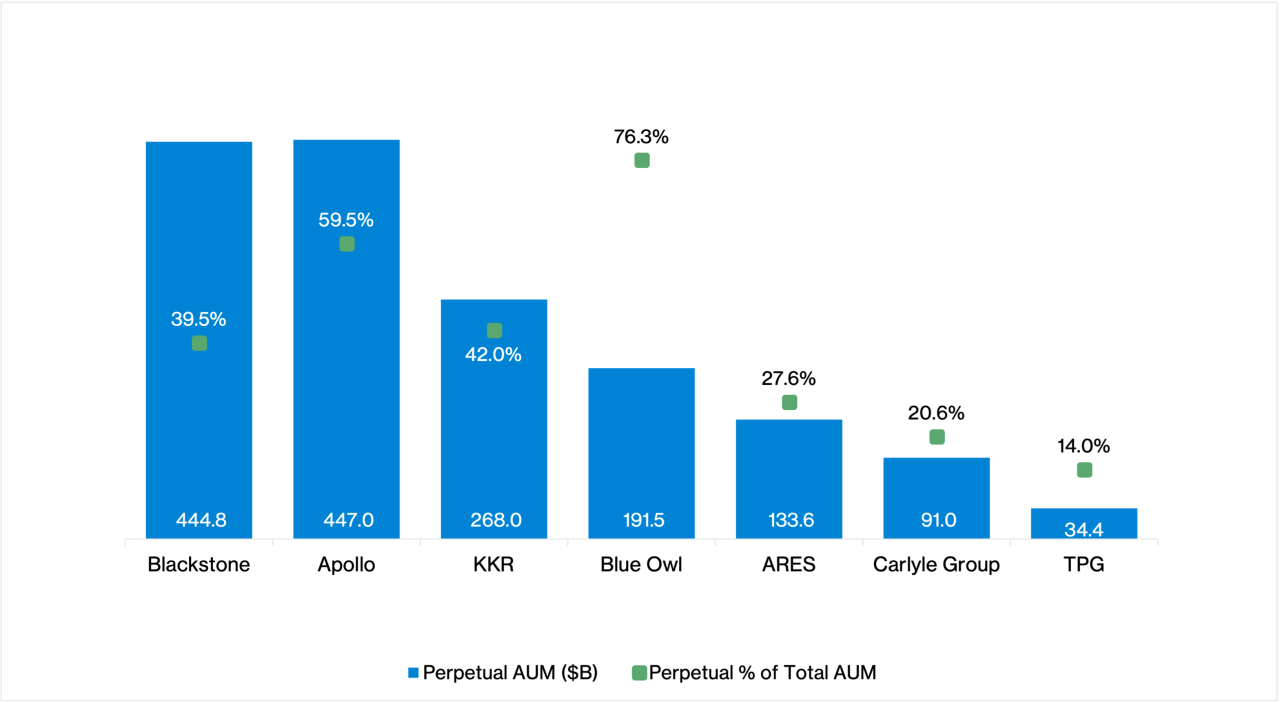

Who is Raising Evergreen Funds?

Evergreen funds are increasingly offered by large, well-capitalized asset managers with extensive private market platforms. Notable entrants include Blackstone, KKR, Apollo, Ares, Partners Group, StepStone, and private wealth platforms like iCapital, CAIS, and Moonfare. These managers leverage scale and institutional deal flow to construct diversified portfolios within a perpetual vehicle.

The cost burden of creating a perpetual fund vehicle precludes smaller players from entering the market. While these large managers have immense staying power and brand recognition, the potential for alpha generation has shifted to smaller managers and smaller target portfolio companies.

Perpetual AUM as a Percentage of Total Assets

Source: PitchBook.

Do Evergreen Funds Belong in Every Portfolio?

Evergreen funds are not a wholesale replacement for drawdown vehicles but an essential evolution in private market investing. These structures serve a distinct purpose: broadening access to private markets, particularly for investors that may not have the operational infrastructure to manage drawdown capital calls and distributions. By eliminating the need for capital commitments and providing immediate deployment, evergreen funds enable capital to be put to work more quickly, thereby reducing the inefficiencies associated with uncalled capital in drawdown funds. Furthermore, evergreen funds enhance the compounding effect on returns by continuously reinvesting proceeds, which could lead to superior long-term value creation.

As a result, institutional adoption is on the rise. Pension funds and insurance companies, drawn to the capital efficiency and reduced J-curve effects of evergreen funds, are allocating more to evergreen funds to complement traditional drawdown structures.

Yet, evergreen funds aren’t about to render drawdown funds obsolete. Most evergreen funds’ broad diversification and liquidity needs result in returns that align with median (or lower) drawdown fund returns and have not kept pace with top-quartile drawdown managers. This means that while evergreen funds offer a valuable alternative for steady exposure to private markets, they aren’t likely to generate the same alpha that investors demand from private equity. Nonetheless, evergreen funds have opened the door to a broader base of investors, giving them access to a once-veiled asset class.

Combining the heavier fee burden with the underlying diversified composition of evergreen funds suggests that investors seeking returns above those of public markets should favor drawdown structures. However, we should keep an eye on evergreen funds, as they continue to develop and improve; they may one day achieve the outperformance that alpha-seeking investors want.

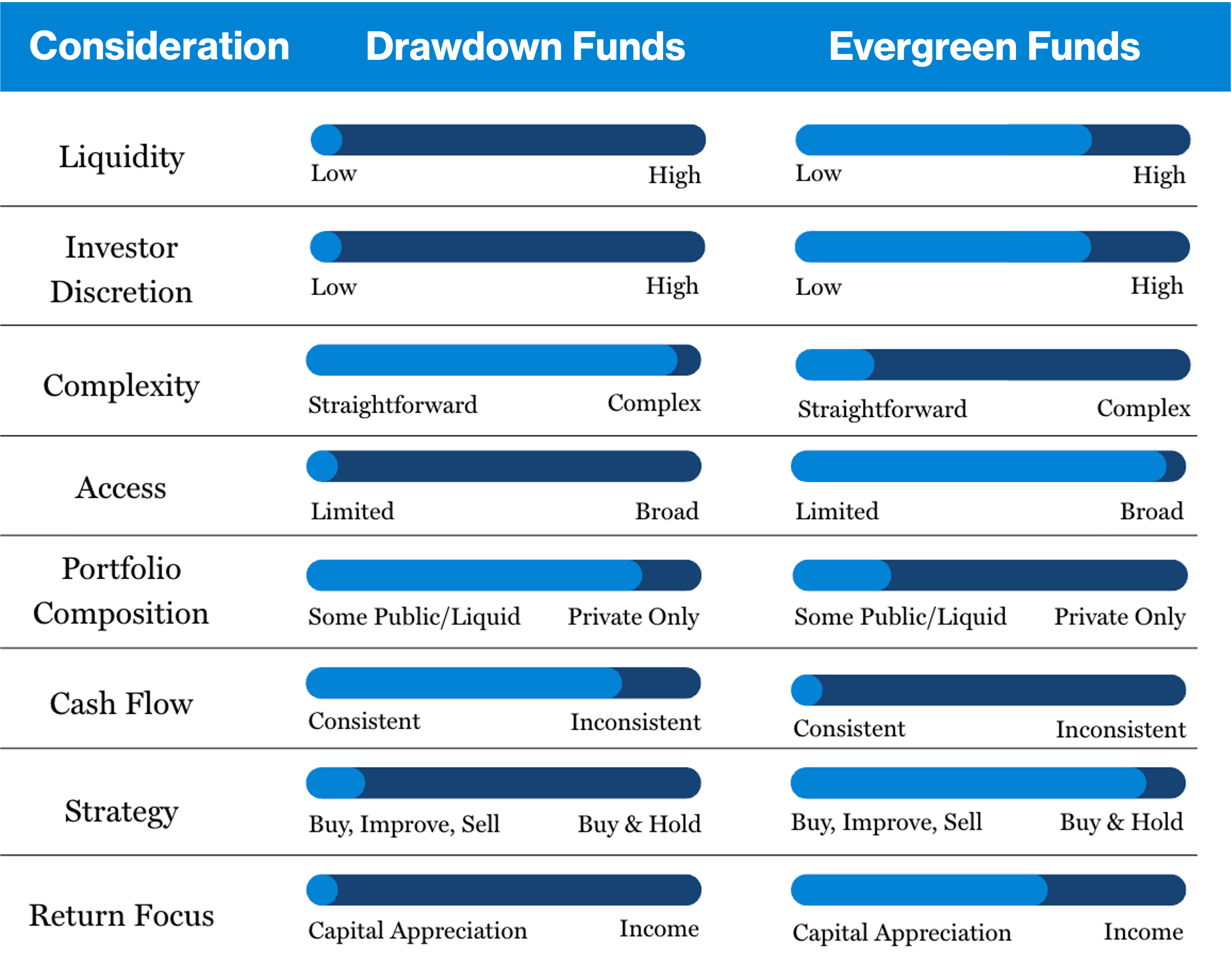

Final Scorecard Summary

Source: ArchBridge Family Office