Key Takeaways:

- Secondaries Offer Speed and Convenience, Not Superior Long-Term Returns – Secondaries shorten the private equity timeline and reduce early “J-curve” effects, but historically they have delivered lower peak performance than high-quality primary funds.

- The Surge in Secondary Market Activity is Driven by Liquidity Pressures, Not Necessarily Better Opportunities – As IPO/M&A markets slow and institutions seek liquidity, secondaries have grown, but rising prices (smaller discounts to NAV) and increased use of leverage have reduced their return advantages.

- For Long-Term Portfolios, Secondaries Are Best Used Tactically, Not Strategically – Because of compressed return potential, reliance on favorable exit markets, and structural concerns (especially with GP-led continuation vehicles), we view secondaries as tools for specific client needs rather than a core allocation.

Why we reserve secondary investments for specific use cases—not for core portfolio construction

Investing in private equity demands patience. A private equity fund takes three to five years to invest your capital, then another five to ten years to manage, improve and exit the investments. In some cases, if an asset isn’t sold, capital may not be returned for fifteen to twenty years.

Secondary funds typically take less patience. They buy existing stakes in private equity funds from other investors at a discount to net asset value (NAV), attempting to shorten this timeline. Unlike primary fund commitments, which provide capital for future investments, secondary funds acquire interests in funds that are already partway through their lifecycle. Purchasing an interest years into a fund’s lifecycle gives the secondary fund manager better insight into asset performance, potentially reduces “blind pool risk,” and may shorten the time before the investor receives a return on their capital.

Why Secondaries Are in the Spotlight Now

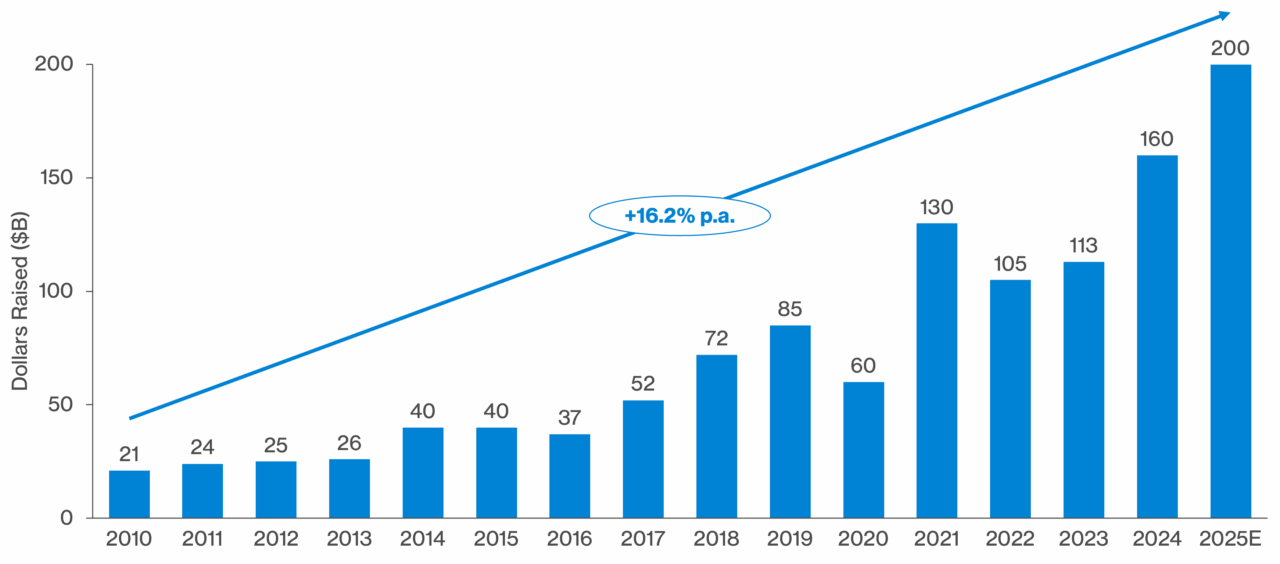

The recent growth of the private equity secondaries market is hard to ignore. Secondaries have evolved from an opportunistic afterthought into a standalone private asset class. Transaction volume is expected to surpass $200 billion in 2025 primarily due to expanding institutional adoption and high-profile institutions like Yale and Harvard selling portions of their portfolios.

Secondary Fundraising By Vintage Year

The post-2021 period has been a pivotal time for the secondaries market. A subdued IPO market and fewer M&A deals, combined with recent worries about tariffs, aging fund vintages, and capital overallocations, have driven a rise in secondary activity. Continuation vehicles (separate investment vehicles that general partners (GPs) use to hold assets beyond the fund’s lifespan, attract new investors, and offer liquidity to existing investors) have become the go-to strategy for GPs managing long-term assets. These strategies are just one part of the growing scope of secondaries—more solutions are continuously emerging to help GPs provide liquidity to current limited partners (LPs) or to access new LPs.

These dynamics have understandably attracted the interest of investors. As portfolios mature and liquidity needs increase, secondaries present a compelling story: shorter durations, faster distributions, and mid-life exposure.

What Secondaries Do Well

Secondary investments offer significant benefits, particularly in tactical or transitional situations. First, they help reduce the J-curve issue by acquiring assets mid-lifecycle, allowing investors to avoid early capital increases and receive distributions sooner. Second, purchasing at a discount to NAV can lead to an immediate mark-up when the GP revalues the assets after close—effectively increasing early unrealized returns. Third, fund durations are significantly shorter than those of primary investments—typically four to six years compared to ten to fifteen years.

Some investors claim that secondaries also mitigate the “blind pool risk” associated with private equity investing (committing to a pool of capital without knowing what the GP will ultimately invest in but trusting their strategy or process). Yet the only way this risk is truly mitigated is if investors participate at the transaction level. As fund investors, that risk still exists and is not mitigated.

Why They’re Not in Our Core Portfolio

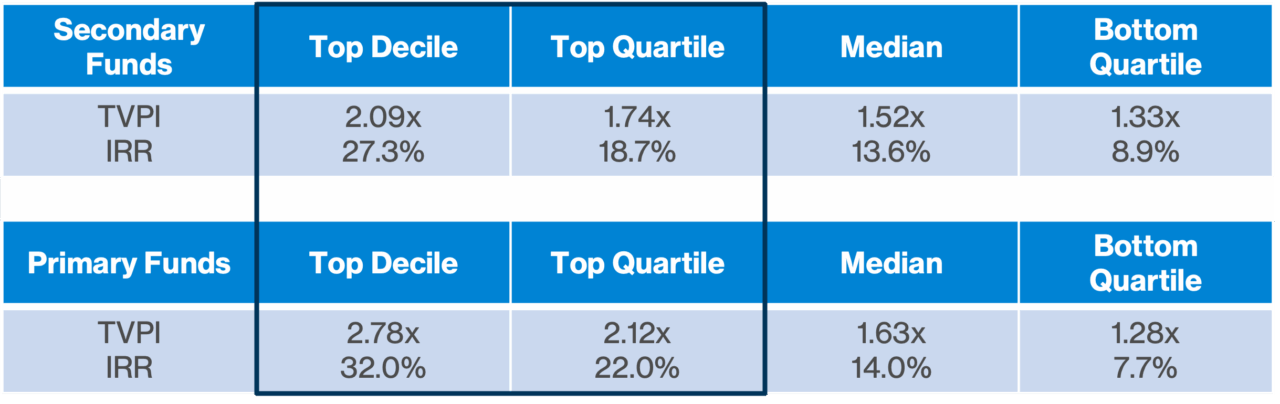

With secondaries offering all the benefits listed above, you might be surprised to learn that ArchBridge Family Office does not include secondary funds in our clients’ core portfolios. Our private portfolios focus on long-term value creation, which we believe is more important than accelerating liquidity, a key advantage of secondary funds. Comparing mature secondary funds to primary funds shows that even the best-performing secondary funds rank in the middle of primary funds. This is demonstrated in the table below, which is based on PitchBook Private Market data and illustrates that even the best-performing secondary funds (top decile managers) do not generate returns as high as those of very good (top quartile) primary funds.

Return expectations will, of course, differ by strategy within the secondaries sector; however, in general they tend to have less variation between upper and lower ranks and a more defined ceiling overall.

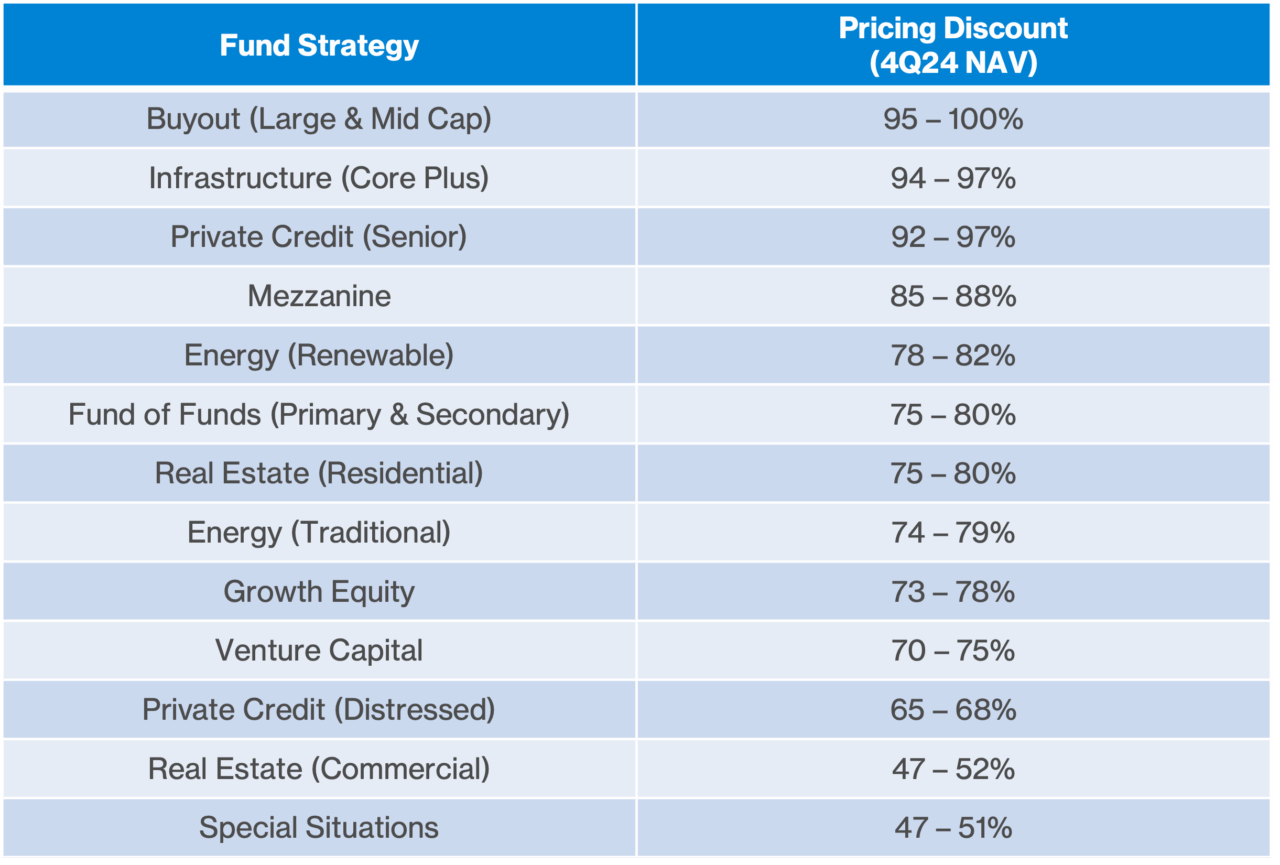

The most critical factor determining secondary returns is the entry price. Secondary investments are typically made at later stages of a portfolio company’s life so determining a value (price) for the investment is extremely important in order to generate an outsized return. Historically, before secondaries gained popularity, pricing discounts were the key draw for investors. Today, secondaries are priced closer to NAV (PEFOX reports an 87% average discount to NAV in Q2 2025), which reduces the entry arbitrage that historically supported strong returns. To achieve IRR targets, many secondary managers now add fund-level leverage. This can improve early performance metrics, but it often causes delays in distributions and increases risk sensitivity during market stress.

GP-led continuation vehicles, once a niche structure, now dominate secondary volume. However, these deals often lack transparency, alignment, and longer hold periods than originally advertised. More concerning, many of the same assets that LPs exit through secondaries are being repackaged with minimal change in fundamentals—leaving investors with the same liquidity issues, just presented differently.

Secondaries, just like primary funds, also depend on a strong exit environment to generate distributions. If IPO and M&A markets remain subdued, secondary portfolios risk becoming trapped capital as well— “short-duration” in name only. Today, secondaries provide liquidity solutions to primary fund investors, but tomorrow, there may not be anyone available to provide liquidity to secondary fund investors.

To summarize, the muted return potential, compressing discount to NAV, and continued concerns over the exit environment all make secondaries a less appealing option for our strategic allocation within private markets.

Our Approach: Disciplined, Not Distracted

Despite all the scale and structural creativity, secondaries are not a complete solution for every investor. Every investor has unique needs. Some are managing complex portfolios with legacy private assets or pacing gaps. Others face tax, estate, or liquidity events that call for flexibility. These scenarios may drive the use of secondaries—as a tactical solution to meet a specific need, but not as a component of the long-term strategy.

We currently do not see secondaries as a suitable core allocation for private portfolios. Their primary benefit is access to liquidity quicker, not generating alpha or compounding returns. We may use secondaries carefully and purposefully—always to achieve a specific client goal, rather than simply filling an allocation quota. We believe that secondaries carry more risk than reward, and although they can be part of the toolkit, they are not the main driver of private portfolio performance.