A.I. infrastructure buildout is the dominant theme in both the U.S. economy and the stock market. Billions of dollars are pouring into the A.I. ecosystem – chipmakers, data centers, software firms, and even power producers. The surge in spending has become a major driver of economic growth, showing up in everything from industrial equipment orders to electricity demand. The A.I. boom is encompassing a vast amount of economic activity and growth, but how much of a footprint does it have in the stock market? Should investors be seeking a greater allocation to companies tied to this theme?

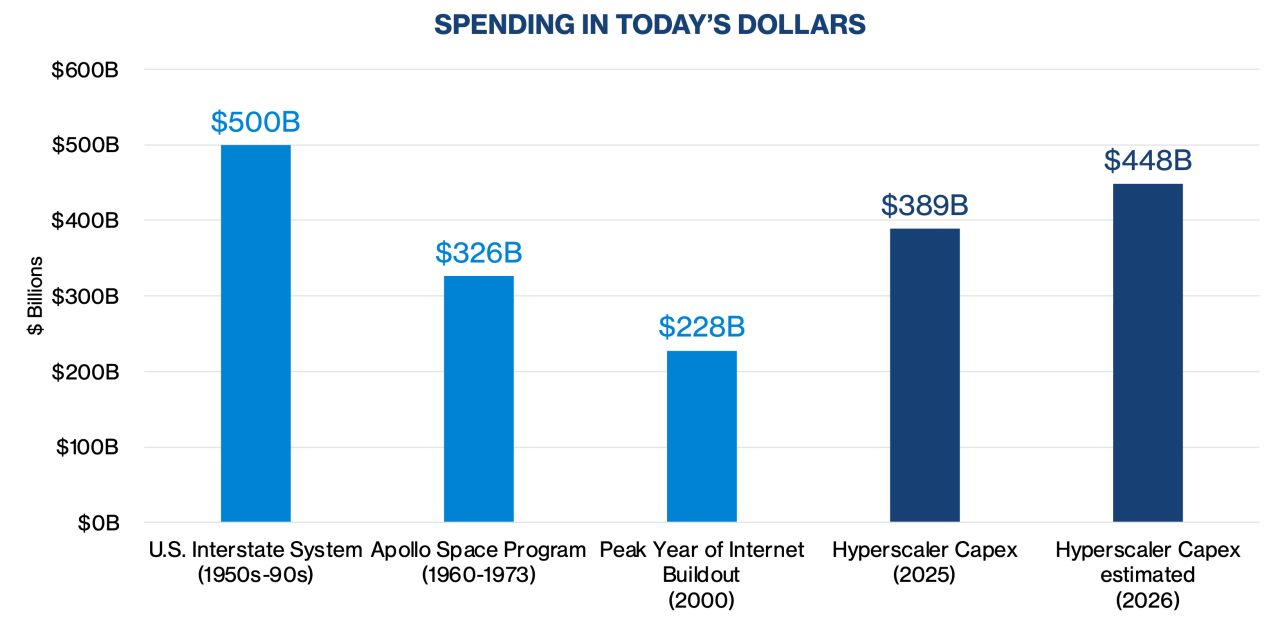

How big an economic presence are we talking about? The scale of corporate spending to enable A.I. is staggering. Hyperscalers – Amazon, Microsoft, Google, Meta, and Oracle – are committing hundreds of billions of dollars in capital expenditures to support cloud infrastructure, semiconductor capacity, and power requirements for training and deploying A.I. models. That’s not just a big corporate capex cycle; it’s on par with some of the most ambitious buildouts in modern history.

The hyperscaler capital spending amount projected for next year eclipses the entire Apollo program costs and is close to rivaling the mammoth scale of the U.S. Interstate buildout!

All of this economic spend and activity hasn’t been lost on the U.S. stock market. While it is consuming a significant share of economic activity and hype, it has also garnered a sizable market share among the U.S. large cap market indexes.

The “Mag 7” stocks – the major technology companies at the core of the A.I. ecosystem – now account for a 34% weighting in the entire S&P 500 Index. In each of the last three calendar years, these stocks have contributed over half of the total S&P 500 Index performance.

According to a recent J.P. Morgan research piece – Since ChatGPT’s release in Nov 2022, A.I.-related stocks* in the S&P 500 have accounted for:

- 75% of the returns

- 80% of the earnings growth

- 90% of the capital spending growth

- A current 42% weighting in the index

The U.S. stock market is resembling more of a concentrated bet than a diversified index.

A.I. concentration has been rewarding in recent years but introduces vulnerability should investor sentiment or business results around A.I. falter. With substantial A.I. exposure already embedded in U.S. large-cap allocations, investors should seek balance through diversification into small caps, international markets, or other areas less reliant on a single growth theme. In today’s market, the question isn’t whether you have A.I. exposure, but whether you have enough diversification beyond it.

*Al-related stocks include NVIDIA, Microsoft, Apple, Alphabet, Amazon, Meta, Broadcom, Tesla, Oracle, Palantir, AMD, Salesforce, IBM, Uber, ServiceNow, Qualcomm, Arista, Adobe, Micron, Palo Alto, Intel, Crowdstrike, Cadence Design, Dell, NXP, Fortinet, Digital Realty Trust, HP and Super Micro Computer.