Remember Liberation Day (April 2nd)? It felt like the economy was being driven off a cliff, and the stock market was going along for the ride. In the weeks surrounding April 2nd, the S&P 500 Index plummeted 19%, with a brutal 10.5% of that drop compressed into just two days – the third-worst two-day stretch in the past 30 years. Then, just days later, investors got whiplash as the market rocketed up 9.5% in a single session, marking the third-best trading day over that same period. The sheer volatility had investors scrambling for their life jackets, many contemplating whether to abandon ship entirely.

But here’s the thing: those who jumped overboard missed the rescue boat as the S&P 500 finished the Second Quarter up 6.2% YTD. The market’s dramatic recovery underscores a critical investing truth – timing the market requires not just one perfect decision, but two. You need to know exactly when to get out and when to get back in. And as Liberation Day proved, the market’s worst and best days often cluster together, making successful timing nearly impossible.

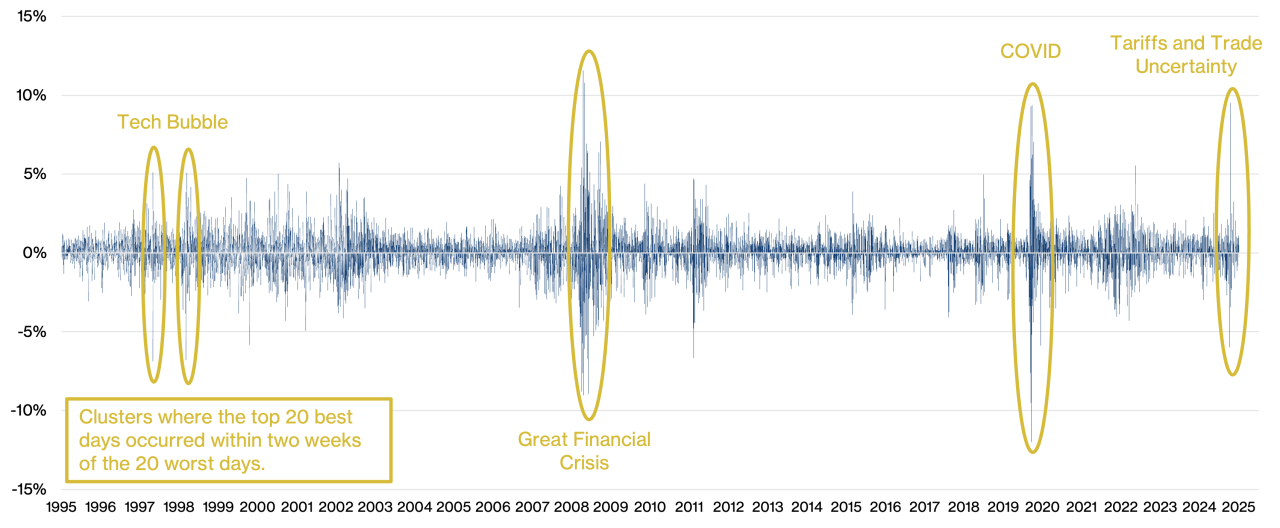

The clustering of market extremes is not an anomaly – it’s a common occurrence. Over the past 30 years, 14 of the market’s 20 best single-day gains happened within just days or weeks of the 20 worst. For example, during the 2008 financial crisis, each one of the S&P 500’s largest daily gains occurred amid a backdrop of historic losses. Similar patterns emerged during the COVID-induced volatility of early 2020. The chart below shows the daily performance of the S&P 500 index and illustrates just how frequently these extremes occur in close proximity. For investors who exit the market after a sharp decline, the risk isn’t just missing a recovery – it’s missing it almost immediately.

S&P 500 Daily Performance Change (%)

Source: FactSet, Data from 6/30/95 to 6/30/25

Volatility clustering happens because during periods of uncertainty–whether driven by economic data, policy shifts, or external shocks–markets tend to overreact in both directions. Or, volatility begets volatility. Emotional responses, algorithmic trading, and rapid repositioning by institutional investors can drive prices far from fundamental value, only to snap back quickly when sentiment shifts. Additionally, large policy announcements, central bank interventions, or encouraging data can catalyze powerful rallies at unexpected moments, often when investor pessimism is peaking.

What’s the takeaway for investors? Stay the course. While it can be tempting to act during market swings – especially when headlines scream crisis – the risk of mistiming the market is greater than the risk of staying invested. A disciplined, long-term approach that aligns with yone financial goals and risk tolerance is more effective than reacting to daily moves. History teaches that missing even a few of the market’s best days can significantly reduce long-term returns. And because those days often occur amid market turmoil, being present for them means enduring the tough days too. The key is not to avoid volatility, but to manage through it with patience and perspective.