Warren Buffett famously advised investors to “be fearful when others are greedy, and greedy when others are fearful.” It’s a catchy line—but is it actually good advice? Do markets really perform better after periods of widespread fear and worse after times of euphoria? Fortunately, there’s a way to test this: by examining how investor and consumer sentiment compares to future stock market returns.

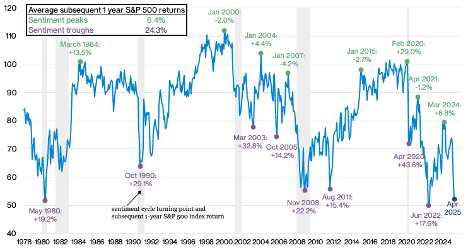

The Index of Consumer Sentiment from the University of Michigan is the most widely-followed sentiment survey. Its questions are centered around how people feel about their personal financial situation, general economic conditions, the market, and what their expectations are for each. The below chart shows relative peaks and troughs of the Consumer Sentiment index and notes the performance of the S&P 500 over the next year.

Consumer Sentiment Index and Subsequent 1-Year S&P 500 Returns

Source: FactSet, University of Michigan, J.P. Morgan Asset Management | Shaded areas indicate recession period

Two key insights jump out from the above chart. First, the S&P 500 Index generally performed better following periods of collective worry (troughs) compared to collective comfort (peaks). This likely reflects that fact that the market is a leading indicator of sentiment. When it’s rising, consumers may react by feeling better and vice versa, with those views and confidence reflected in each subsequent survey. Feelings are chasing markets, not the other way around. This helps explain why markets have tended to turn before our collective emotions were calibrated to it. (Recall the market bottoming in the early onset of COVID.)

Second, there’s no precise sentiment level that consistently signals a top or bottom. Sometimes the index bottoms near 70; other times, it dips below 60. Likewise, sentiment peaks have occurred anywhere between 80 and 110. So, sentiment isn’t a precise market-timing tool—it’s more of an “ish.”

Our advice? Use sentiment as a behavioral guide rather than a trading signal. When optimism is high, resist the urge to chase returns. When fear dominates, remind yourself that these are often the times that set the stage for strong future gains. It’s OK to worry or be optimistic about the markets. Feel free to answer any survey, just don’t act on one.