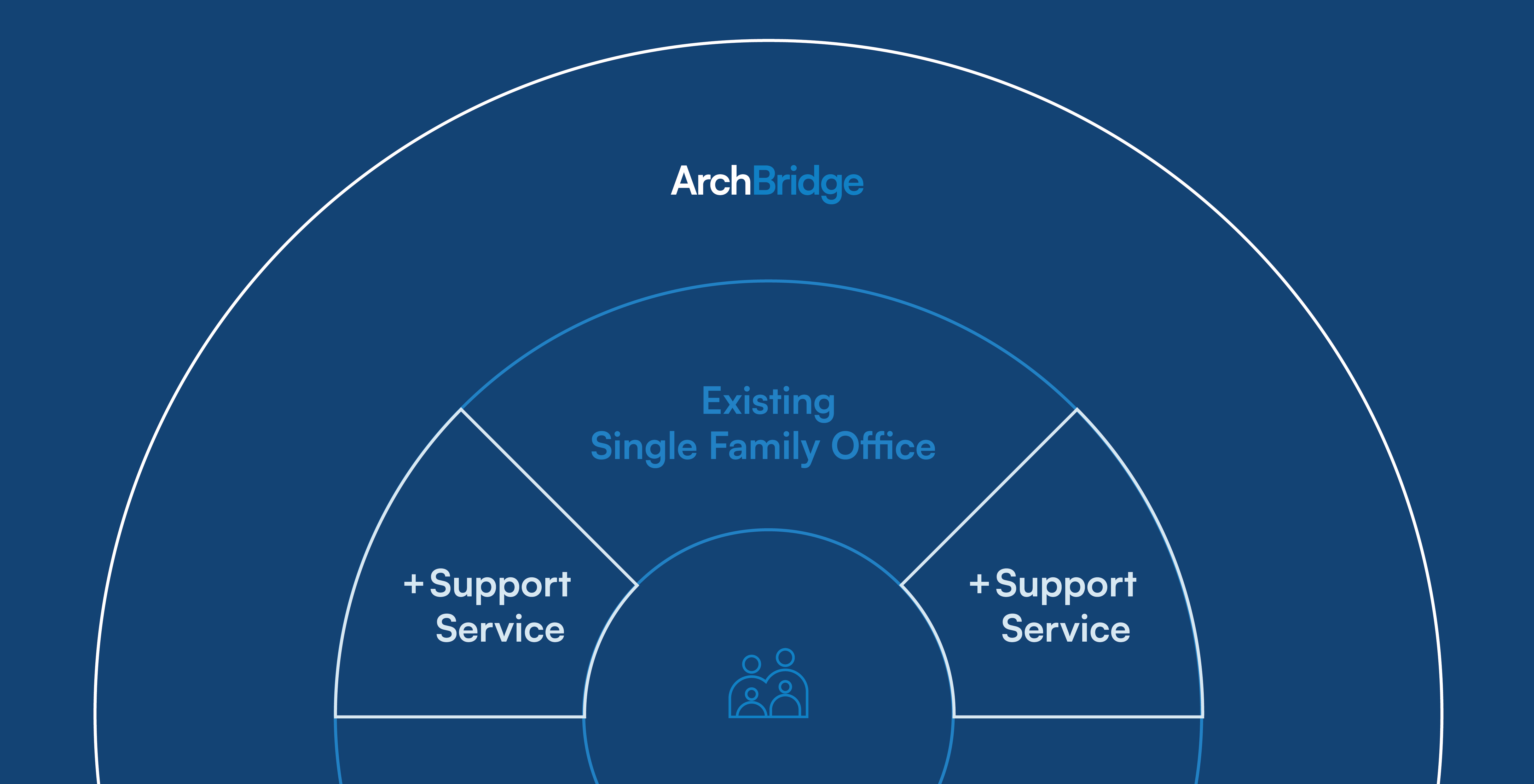

Bringing Depth to Your Team

As families and their wealth grow, in-house single-family office teams are asked to take on more responsibilities and duties. We respect the relationship between families and their single family offices. Our role is to enhance the services they can provide, while allowing them to continue providing their families with the best service and customized advice. We’ll customize our role to fit the needs of the overall team.

Reporting & Recordkeeping

- Provide customized reports created exclusively for families with significant wealth.

- Aggregate data from multiple custodians and entities for all-inclusive consolidated balance sheet reports.

- Monitor and report on both liquid and non-liquid assets.

Risk Management

- Evaluate/provide asset-protection planning strategies.

- Perform cyber-security review and analysis.

Family Education, Support, and Administration

- Facilitate family education meetings.

- Support administrative needs, including bill payment and household employee sourcing.

Corporate Trustee & Trustee Support Services

- Serve as trustee.

- Assist clients with their fiduciary duties.

Investment Management & Support

- Offer a wide range of investment management services, from being a fully-outsourced CIO to merely being a sounding board for various investment opportunities.

- Help minimize the “controllable” factors that negatively affect investment returns.

Planning Expertise (Tax, Legal, Charitable)

- Actively maintain collaborative partnership with existing client advisors.

- Develop, coordinate, and administer tax, estate and charitable planning strategies.

Single Family Office Support Insights

More Single Family Office Support ArticlesFamily Office

How to Decide What Your Family Office Should Outsource

Investment Management